Your industry partner with industry experience

Get up and running quickly with a team that has been there and done that.

2011

Blaze Portfolio launches cloud platform

Integrates with Advent

and Orion

2013

Integrates with Black Diamond

$1 Billion

in electronic

trades milestone

2016

Integrated with Addepar and other leading platforms

2017

Launches scalable modern cloud architecture

2018

Releases option trading strategies

2020

LPL acquires Blaze Portfolio

2021

Launches newly designed HTML5 platform

Frequently asked questions

We now have an FAQ list that we hope will help you answer some of the more common ones.

1. Why do I need portfolio rebalancing software?

The simple answer? Accuracy, efficiency and growth.

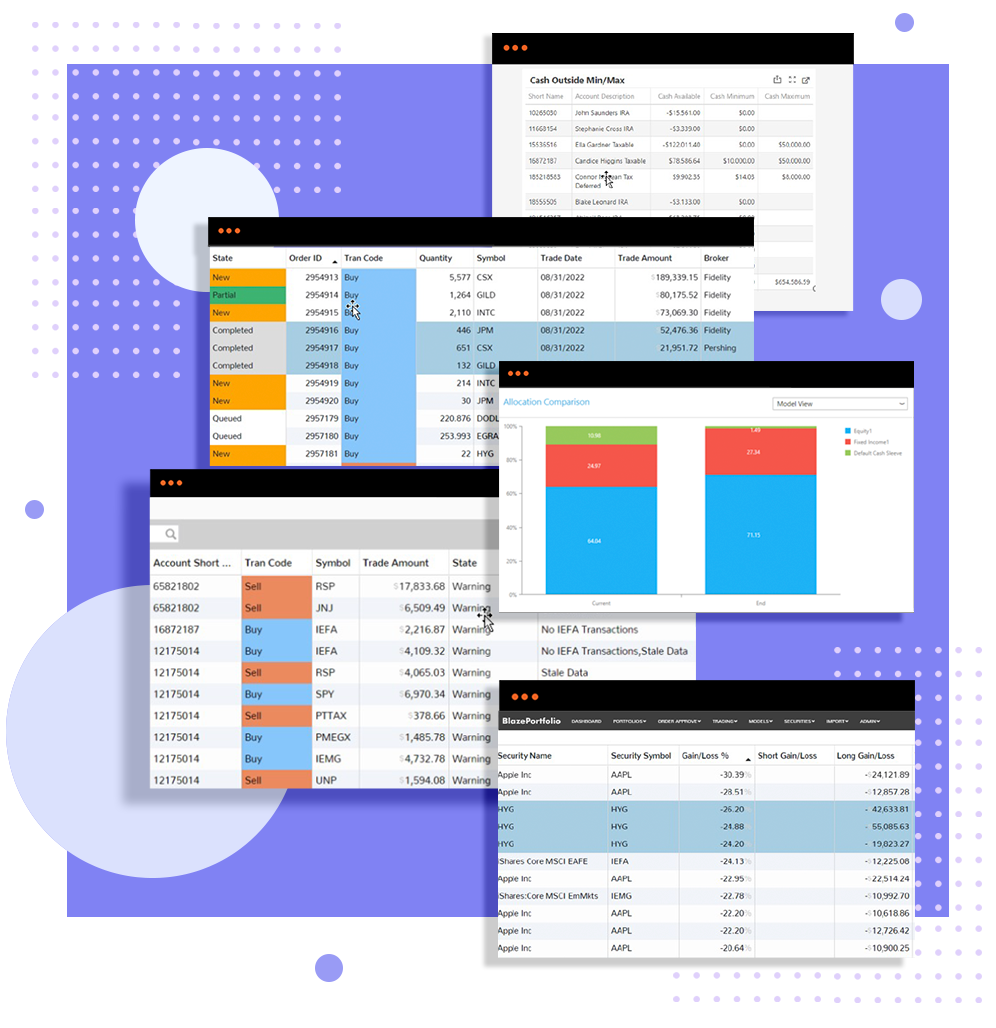

Rebalancing software helps advisors avoid trading errors, implement trading strategies and complex models, automate cash management and drift monitoring and improve scalability. Blaze Portfolio delivers the most secure, flexible and easy-to-use software in the industry.

2. What does Blaze Portfolio offer that other portfolio rebalancing software providers don't?

Flexibility. Order Management. Compliance. Security.

-

- Flexibility. Software that doesn’t play well with others isn’t of much value. Blaze integrates with your existing software and provides electronic trading connectivity to major custodians. Blaze accommodates customized modeling and trading workflows, while simultaneously incorporating real-time market data, trading compliance, and unique client requirements.

-

- Order Management. Consistent, accurate and timely trades are critically important regardless of your size or trading volume. No other portfolio rebalancing software streamlines the entire life cycle of your trades—trade creation, review, approval, execution, allocation and next-day matching. With sophisticated FIX electronic trading capabilities, you can send trades and allocations to custodians and brokers instantly, communicate directly with trading desks and use execution algorithms.

-

- Security. Nothing is more important to you or to us. Blaze/Atom Align is private cloud-hosted software, making it more secure than software hosted internally or in the public cloud. We partner with Rackspace, the largest managed hosting provider in the world, and leverage their expertise to continually improve the reliability and security of our software infrastructure. Learn more about our security here.

3. What about all the other features we've come to expect from portfolio rebalancing software?

Blaze has them all—flexible models, tax optimization, drift analysis, cash management—in an easy to use, intuitive interface. What clients like the most is our unlimited product support and comprehensive implementations which ensure the success of every client.

Learn more about our features here.

4. We run particularly complicated models. How can I be sure Blaze Portfolio will work for us?

Senior team leaders have more than 20 years of experience using designing and developing trading and investment management software. At Blaze Portfolio we pride ourselves on creating software that can handle every level of sophistication in modelling, workflows and variables.

5. I don't execute trades in large volumes. Why would I need Blaze Portfolio?

Compliance. Analysis. Accuracy.

RIAs face increasing scrutiny and compliance pressures. With Blaze Portfolio, you can be sure you have the proper safeguards and supervision over your trade operations to remain compliant and readily demonstrate that compliance.

Regardless of trade volume, Blaze Portfolio’s intuitive platform gives you exceptional line-of-site to your business–across clients, strategies, sleeves, investment classes, tax implications, cash balances and more.

Whether you execute a handful of trades a quarter or hundreds in an hour, accuracy is critical. Blaze Portfolio’s order management functionality gives you the confidence to scale your rebalancing and trading workflows. That’s value your clients understand.

6. How long does it take to implement?

This depends on your firm and your team. On average, 4-6 weeks.

7. How much does Blaze Portfolio cost?

Blaze Portfolio is competitively priced for its functionality, flexibility and security. The number of accounts and users, as well as AUM affects pricing. Contact us for a demo and price estimate.