Guest post written by Brian Donovan.

Want to Know the Value of your Clients’ Stocks?

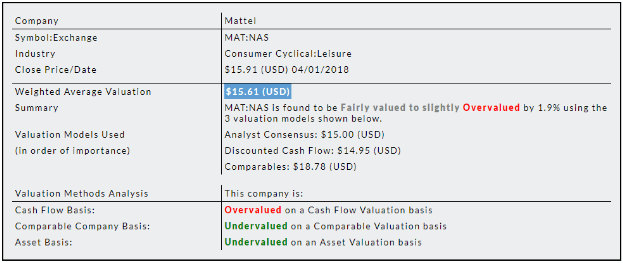

StockCalc (https://www.stockcalc.com) is a Fundamental Valuation Platform – At StockCalc we run 8000 public companies (NYS, NAS, Canadian markets) through 6 valuation models each night and generate a valuation report for each (see Sample Report).

This will enable you to have a ready reference of valuation data and link your client holdings in to see the under and overvalued stocks they hold. If you choose, we can link to your custodian data and have your clients holding valued for you each morning.

| Symbol | Exch | Company Name | Date | Price | Valuation |

| ABEV | NYS | Ambev | 2018-02-27 | 6.72 | 7.48 |

| ABG | NYS | Asbury Automotive Group | 2018-02-27 | 68.90 | 57.37 |

| AG | NYS | First Majestic Silver | 2018-02-27 | 5.57 | 8.15 |

| AGC | NYS | Advent Claymore | 2018-02-27 | 5.81 | 6.14 |

| AGCO | NYS | AGCO | 2018-02-27 | 68.44 | 63.56 |

| AGD | NYS | Alpine Global Dynamic | 2018-02-27 | 11.08 | 11.27 |

| AGEN | NAS | Agenus | 2018-02-27 | 5.06 | 7.09 |

| AGFS | NAS | AgroFresh Solutions | 2018-02-27 | 7.97 | 5.9 |

| AGI | NYS | Alamos Gold | 2018-02-27 | 5.09 | 9.34 |

| AGII | NAS | Argo Group International | 2018-02-27 | 59.25 | 55.43 |

| AGIO | NAS | Agios Pharmaceuticals | 2018-02-27 | 82.83 | 78.78 |

| AGLE | NAS | Aeglea BioTherapeutics | 2018-02-27 | 6.29 | 6.80 |

Fundamental Valuation Platform Integrations

With our Blaze Portfolio integration we are offering a free 30 day trial or use the promo code “BlazePortfolio30”.

If you are interested in the details, we have up to 6 valuation points calculated for each company and calculate the weighted average Valuation based on a number of factors including industry and model results. Free Valuation eBook

| Symbol | Price | Value | DCF | Comp | Comp2 | Multiple | ABV | Target |

| ABEV | 6.72 | 7.48 | 7.77 | 3.310 | 5.27 | 5.46 | 5.850 | 7.83 |

| ABG | 68.90 | 57.37 | -32.89 | 47.49 | 80.63 | 101.07 | 75.250 | 58.00 |

| AG | 5.57 | 8.15 | 6.54 | 5.05 | 8.76 | 11.93 | 8.730 | 10.25 |

| AGC | 5.81 | 6.14 | 0.000 | 6.19 | 7.75 | 6.06 | 10.370 | 0.00 |

| AGCO | 68.44 | 63.56 | 28.660 | 48.89 | 64.05 | 56.73 | 56.190 | 75.80 |

| AGD | 11.08 | 11.27 | 0.000 | 18.98 | 11.53 | 11.11 | 11.370 | 0.00 |

| AGEN | 5.06 | 7.09 | -4.840 | 2.44 | 7.21 | 6.67 | -4.510 | 7.000 |

| AGFS | 7.97 | 5.99 | 0.000 | 17.53 | 15.36 | 6.55 | 5.620 | 0.00 |

| AGI | 5.09 | 9.34 | 1.280 | 2.82 | 8.35 | 5.95 | 7.970 | 11.597 |

| AGII | 59.25 | 55.43 | 25.890 | 55.48 | 86.02 | 50.98 | 56.880 | 0.00 |

| AGIO | 82.83 | 78.78 | 10.740 | 64.72 | 91.67 | 40.95 | 53.360 | 78.667 |

| AGLE | 6.29 | 6.80 | 0.000 | 8.45 | 11.08 | 3.97 | 5.010 | 8.000 |

StockCalc Valuation Platform Features

The Discounted Cash Flow (DCF) valuation is a cash flow model where cash flow projections are discounted back to the present to calculate value per share. DCF is a common valuation technique especially for companies undergoing irregular cash flows such as resource companies (mining, forestry, oil and gas) going though price cycles or smaller companies about to generate cash flow (junior exploration companies, junior pharma, technology firms…).

The Price Comparables (Comp) valuation is the result of valuing the company we are looking at on the basis of ratios from selected comparable companies: Price to Earnings, Price to Book, Price to Sales, Price to Cash Flow, Enterprise Value (EV) to EBITDA. Each of these ratios for the selected comparable companies are averaged and multiplied by the values for the company we are interested in to calculate a value per share for our selected company.

We have included the Other Comparables (Comp2) as a way to value companies that cannot be valued using Earnings based ratios. This technique is very useful for companies still experiencing negative cash flows such as mining exploration firms. We use Cash/Share, Book Value/Share, MarketCap, 1 Year Return, NetPPE as the ratios here. Each of these ratios for the selected comparable companies are averaged and multiplied by the values for the company we are interested in to calculate a value per share for our selected company.

Multiples are similar to Price comparables where we look at current or historic ratios for the company in question to assess what it should be worth today based on those historic ratios. We use the same 5 ratios as in the price comparables and value the company with its historic averages.

With Adjusted Book Value (ABV) we calculate the book value per share for the company based on its balance sheet and multiply that book value per share by its historical price to book ratio to calculate a value per share.

If we have Analyst coverage for the company, we use the consensus target price here.

Remember with our Blaze Portfolio integration we are offering you a free 30 day trial. It is risk free, you can cancel anytime, and the best part is that you can test your custodial data during the trial.

The contents of this report and the Stockcalc website are provided on an ‘‘as is’’ or ‘‘as available’’ basis with all faults and may not be current in all cases. The information in this report or on the website is subject to continuous change and Patchell Brook Equity Analytics Inc. assumes no responsibility to update or amend such information or that the information will be current. Patchell Brook Equity Analytics Inc. does not claim that all information, calculations or opinions presented in this report or on its website are true, reliable, or complete. Accordingly, you should not rely on any of the information as authoritative or as a substitute for the exercise of your own skill and judgment in making an investment or other decision. Any information, data, opinions, calculations or recommendations provided by third parties through links to other websites or otherwise made available through this report or website are solely those of the third party and not of Patchell Brook Equity Analytics Inc. Please refer to the Terms of Use on www.stockcalc.com for further information. To access all of the tools on Stockcalc, including more detailed valuation reports and the models used to generate these valuations, please subscribe for a free 30 day trial of Stockcalc here.